Several commercial health insurers will waive member cost-sharing — which includes copays, deductibles and coinsurance — for COVID-19 testing and treatment into the next year.

As an organization, United Healthcare has moved swiftly to support member’s health care needs during this trying time. Between May 11, 2020 and until at least September 30, 2020 United Healthcare has waived copays for primary care doctor office visits and specialist visits for.

Here are 14 commercial payers that have announced extensions to their COVID-19 cost-sharing waivers into 2021, per America's Health Insurance Plans. As of Dec. 2, the federal public health emergency period is scheduled to end Jan. 21, so many of the policies below also end on that day.

Providers sometimes waive patients' cost-sharing amounts (e.g., copays or deductibles) as an accommodation to the patient, professional courtesy, employee benefit, and/or a marketing ploy; however, doing so may violate fraud and abuse laws and/or payor contracts.From a payor's perspective, waiving cost-sharing amounts creates two problems. First, payors often contract with providers to pay. To help with this, UnitedHealthcare is waiving member cost-sharing for the treatment of COVID-19 based on confirmed positive diagnosis through the national public health emergecy period for Medicare Advantage, Medicaid, Individual and Group Market fully insured health plans. Implementation for self-funded employer customers may vary. During this unique and challenging time, UnitedHealthcare has taken a number of steps to ensure our members have access to the care they need. With the extension of the National Public Health Emergency, we have updated our policies waiving cost-sharing for COVID-19 testing-related visits, testing and treatment, as well as telehealth coverage. UHC wanted to share more details with you concerning the over $1.5 billion of additional support for our customers affected by the COVID-19 pandemic. 1-800-772-6881 support@pfsinsurance.com Facebook.

Editor's note: Policies vary by insurer. This list will be updated if more announcements are made. Email mhaefner@beckershealthcare.com if your company has implemented similar measures.

1. Aetna is waiving member cost-sharing for inpatient admissions to treat COVID-19 for commercially insured and Medicare Advantage members through Jan. 31.

2. Arkansas Blue Cross and Blue Shield expanded COVID-19-related benefits for fully insured and individual health plans through Jan. 21.

3. Avera Health Plans will waive cost-sharing for COVID-19 treatment with in-network providers through Jan. 21.

4. Blue Cross and Blue Shield of Kansas City will waive cost-sharing and copayments for COVID-19 inpatient hospital admissions through Jan. 20.

5. Blue Cross Blue Shield of Michigan and Blue Care Network will continue to waive cost-sharing for members who are diagnosed and treated for COVID-19 through March 31.

6. Blue Cross and Blue Shield of Minnesota is extending its cost-sharing waiver for in-network COVID-19 treatment through March 31.

7. Blue Cross and Blue Shield of Nebraska will waive cost-sharing for in-network COVID-19 testing and related services through Jan. 20.

8. Blue Cross and Blue Shield of North Carolina is extending its cost-sharing waiver for COVID-19 treatment through March 31.

9. Capital Blue Cross is waiving cost-sharing for provider visits that result in a COVID-19 test through Jan. 21.

10. Cigna is waiving out-of-pocket costs for COVID-19 visits with in-network providers through Jan. 21.

11. Premera Blue Cross is extending cost-sharing waivers for COVID-19 treatment through March 31 for both inpatient and outpatient treatment.

12. Priority Health will waive cost-sharing for medically necessary treatment of COVID-19 through March 31.

13. QualChoice Health Insurance has waived cost-sharing payments for telehealth visits, and no pre-authorization is required through Jan. 21.

14. Security Health Plan is covering inpatient and observation treatment related to COVID-19 at 100 percent through Jan. 21.

More articles on payers:

UnitedHealthcare delays coding changes for lab tests

New Jersey school board sues Horizon, says insurer threatened to stop paying claims for 14,000 workers

18 payer exec moves in November

© Copyright ASC COMMUNICATIONS 2021. Interested in LINKING to or REPRINTING this content? View our policies by clicking here.

Published April 2, 2020

Follow our Medicare Coronavirus News page for related information on coronavirus (COVID-19) and its impact on Medicare beneficiaries.

The Centers for Medicare & Medicaid Services (CMS) mandated in early March that all testing for COVID-19 be covered in full by Medicare and private Medicare insurance carriers. A COVID-19 vaccine will also be covered if and when one becomes available.

Now, some private insurance carriers are going a step further by eliminating cost-sharing for COVID-19 treatment protocols as well.

Cigna, Humana and Aetna have each taken measures to reduce out-of-pocket spending for their Medicare plan members who undergo treatment for the disease. These out-of-pocket costs can include plan deductibles, coinsurance and copayments.

COVID-19 treatment can potentially include inpatient hospital stays, doctor’s office appointments, inpatient skilled nursing facility stays, home health visits and emergency ambulance transportation.

These services can typically come with costs such as copays and deductibles.

With waived coinsurance and deductibles for COVID-19 treatment, savings can add up

Cigna and Humana both waived COVID-19-related cost-sharing for their Medicare Advantage (Medicare Part C) plans.

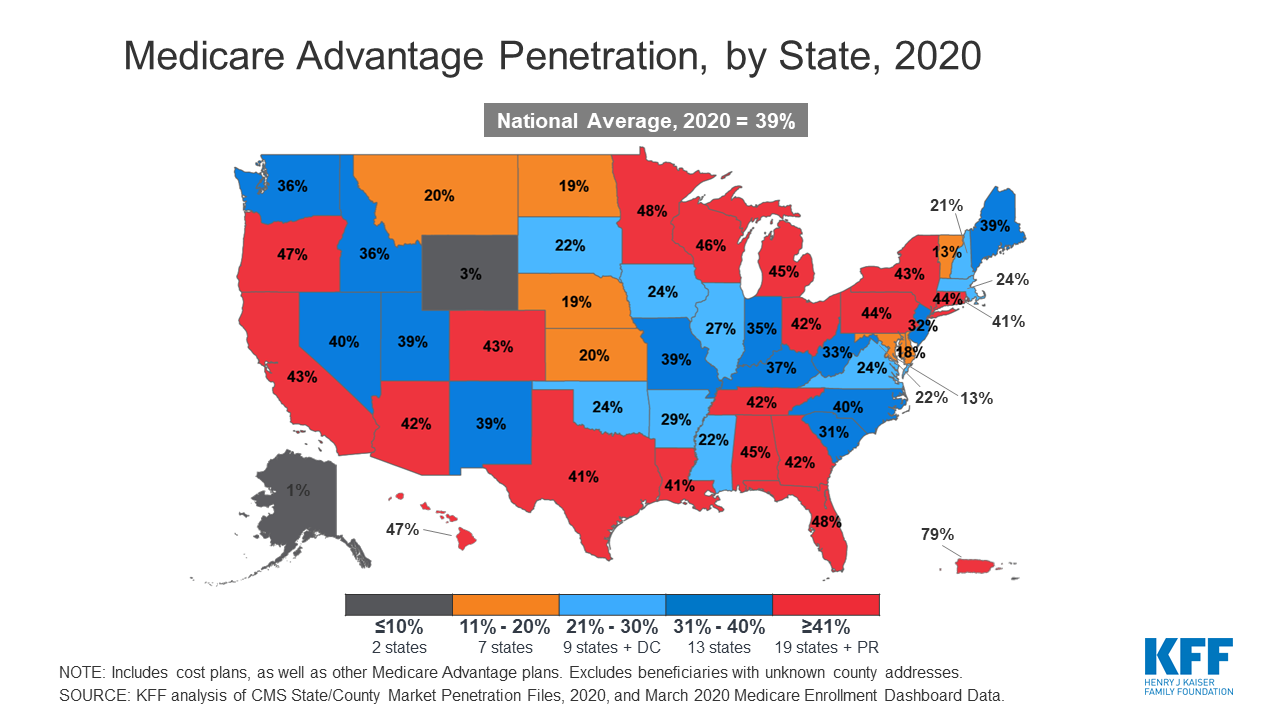

Medicare Advantage plans cover the same inpatient and outpatient services and items that are covered by Original Medicare (Medicare Part A and Part B).

While Original Medicare is provided by the federal government, private insurance companies administer Medicare Advantage plans.

Some of the out-of-pocket costs that a beneficiary who has Original Medicare may face if they receive covered COVID-19 treatment include:

- Beneficiaries who have Original Medicare and who receive inpatient hospital treatment for COVID-19 will typically have to pay the 2020 Medicare Part A deductible of $1,408 for each benefit period that they receive inpatient care.

There are also Part A daily coinsurance costs for lengthy hospital stays that last longer than 60 days. - Beneficiaries who have Original Medicare and who receive outpatient care must pay the 2020 Part B deductible of $198 per year before Medicare covers the costs of their outpatient care.

After meeting the Part B deductible, beneficiaries typically pay a 20 percent coinsurance or copay for covered services and items.

For members of Medicare Advantage plans from Cigna and Humana, however, those costs will be waived for covered COVID-19 treatment.

“Our customers with COVID-19 should focus on fighting this virus and preventing its spread,” David M. Cordani, President and CEO of Cigna1

“While our customers focus on regaining their health, we have their backs,” David Cordani, President and CEO of Cigna, said in a statement.

Cigna’s cost-sharing waiver expires May 31, 2020.

“We know we’re uniquely positioned to help our members during this unprecedented health crisis,” said Bruce Broussard, President and CEO of Humana. “It’s why we’re taking this significant action to help ease the burden on seniors and others who are struggling right now.”2

Humana’s waivers includes costs related to COVID-19 treatment by both in-network and out-of-network facilities or physicians.

Humana’s cost sharing waivers currently have no end date, as the company plans to readdress the situation as needed.

Aetna, a CVS Health company, is also dismissing COVID-19-related inpatient cost-sharing for its members.

Uhc Medicare Waiving Copays Form

“The additional steps we’re announcing today are consistent with our commitment to delivering timely and seamless access to care as we navigate the spread of COVID-19,” said Karen S. Lynch, president of Aetna Business Unit. “We are doing everything we can to make sure our members have simple and affordable access to the treatment they need as we face the pandemic together.”3

United Healthcare Insurance Copays

Aetna’s cost-sharing waiver for inpatient admissions to any in-network facility for treatment of COVID-19 is currently in effect until June 1, 2020.